Tokenization is the process of representing real-world assets on a blockchain through digital tokens. These tokens reflect legally enforceable rights and can represent ownership, claims, or conditional interests.

Paycre is not a token issuer. Paycre is the transaction, compliance and settlement layer that makes tokenized real-world assets usable in regulated environments.

KYC, AML and jurisdictional checks linked directly to wallet addresses.

Conditional fund and token release based on legal and compliance rules.

Coordinated on-chain and off-chain execution with full auditability.

Timestamped logs and legal evidence suitable for regulators and courts.

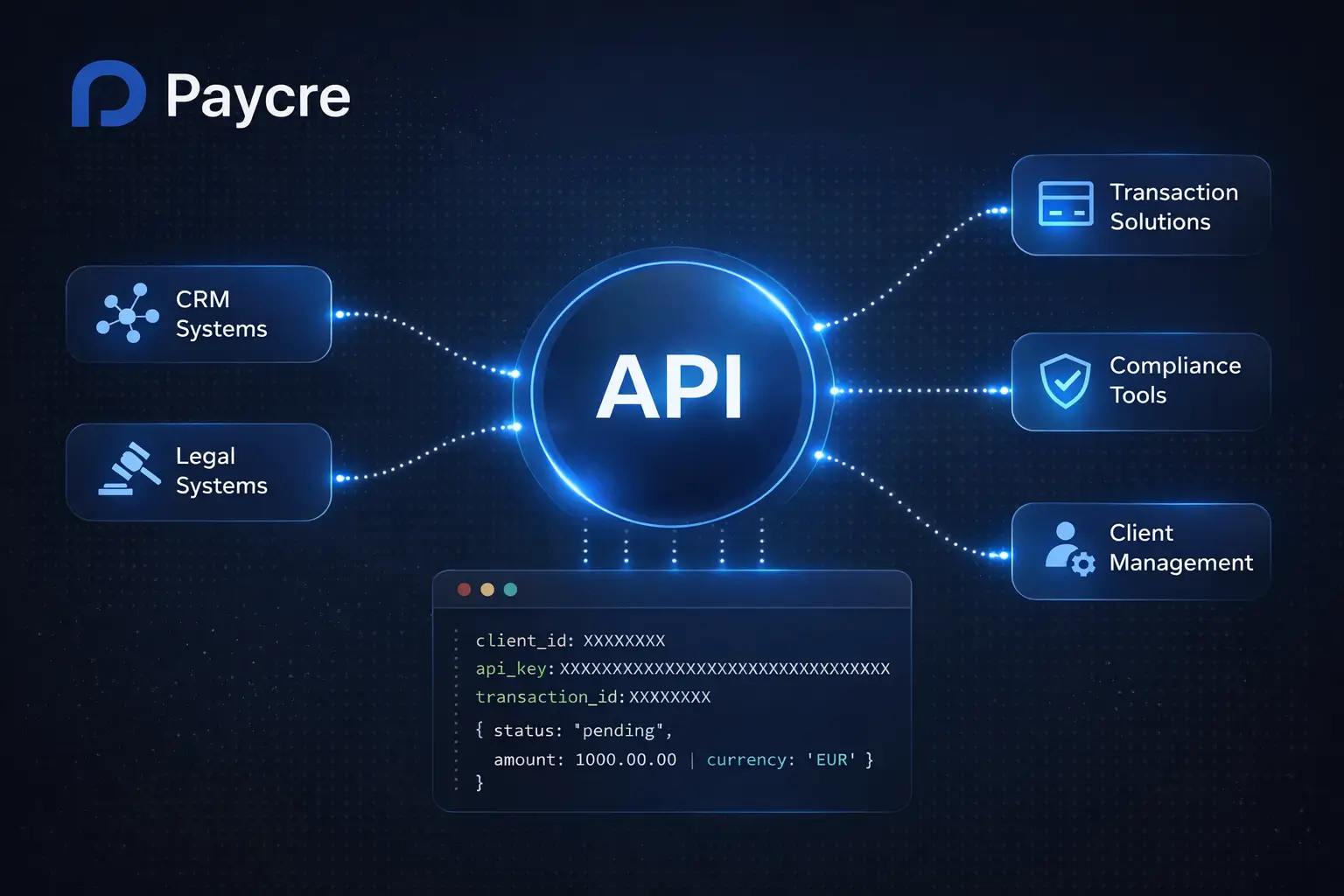

Paycre APIs allow tokenization platforms, law firms and asset managers to integrate compliance-aware transaction workflows directly into their systems.

Tokenized property shares with compliant settlement.

Subscription, redemption and investor onboarding.

Escrow-based tokenized settlements with evidence.

Art, collectibles and high-value assets.

Define asset and legal structure

Integrate Paycre APIs

Configure compliance and workflows

Launch regulated tokenized transactions

For developers, brokers, and regulated professionals